Bank of America's AI Revolution in Global Banking

Bank of America’s AI-powered virtual assistant Erica has become one of the world’s most prominent banking chatbots, transforming customer service and internal operations on a scale covered by global media outlets and acknowledged by top industry analysts

Bank of America's AI Revolution in Global Banking

Erica was launched in 2018 with the goal to make banking more intuitive, responsive, and accessible for Bank of America’s nearly 69 million consumer and small business clients worldwide. As of August 2025, Erica has surpassed 3 billion client interactions and is averaging 58 million sessions per month, reflecting extraordinary engagement and sustained adoption by users across banking, investment, and employee support channels

Technology, Features, and Continuous Innovation

Powered by advanced machine learning and natural language understanding, Erica can recognize and respond to millions of client questions from a dynamic library of more than 700 unique prompts. The system receives thousands of updates yearly to improve accuracy and customer experience. A decade of AI innovation has allowed Erica to not only support personal banking—such as budgeting, transaction search, and bill reminders—but also to be embedded in platforms like Merrill (wealth management), Benefits OnLine (HR), and CashPro (business banking).

Recent upgrades have prepared Erica for generative AI integration, enabling even more natural, contextual support for complex financial topics, and expanding Erica’s role in automating IT tasks, health benefits, and payroll for Bank of America’s 213,000 employees

Global Recognition and Industry Leadership

Erica’s success has been widely reported in business media (e.g., Forbes, Wall Street Journal, CNBC) for its outsized impact on digital banking trends, customer satisfaction, and operational efficiency. Global Finance magazine named Bank of America the top U.S. consumer bank for AI use and the best chatbot/virtual assistant in North America. Independent studies like those from Forrester and J.D. Power have found Bank of America’s mobile app—anchored by Erica—leads national banks in customer satisfaction and digital experience, outpacing competitors by meeting or exceeding expectations in 23 out of 25 performance categories

Real-World Benefits and User Experiences

Customer Satisfaction: Erica’s smart self-service features and easy escalation to human agents have reduced friction and improved trust, helping clients find answers to 98% of their queries, and dramatically decreasing call center load.

Employee Productivity: More than 90% of BOFA’s employees use “Erica for Employees,” halving IT help desk calls and streamlining routine HR tasks; this is increasingly vital as BOFA expands Erica’s generative AI capabilities.

- Continuous Expansion: BOFA’s ongoing investments will broaden Erica’s search and assistance, moving toward even deeper personalized recommendations and global market integration

Erica has set a new standard in AI-driven financial assistance, blending technology and a human touch to offer seamless client support, deeper personalization, and strategic operational gains. Its story is a reflection of Bank of America’s commitment to global digital leadership and the future of smart banking.

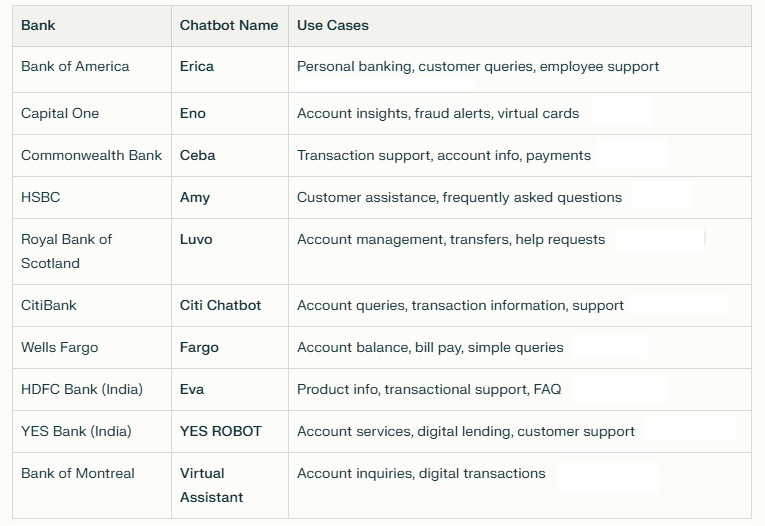

Several other banks, not just Bank of America, now use AI chatbots

Our mission is to empower small and medium-sized businesses through cutting-edge AI solutions that reduce costs, boost efficiency and availability, freeing up valuable time and resources to focus on innovation, strategic initiatives, and high-impact work